Tax Mapping

Taxes You Pay Will Be Your Largest Expense Over Your Lifetime

If you’re legally entitled to lower your taxes, it only makes sense to use every lawful strategy to keep more of your

hard-earned money—so you can spend it where you choose, not where the government decides.

Pro-Active Tax Planning

Tax Planning is not the same as Tax Preparation!

After close to 40 years in practice, we have come to the conclusion that our tax community is not prepared for tax planning.

Most people who hire an accountant or CPA are under the assumption that they are getting tax planning, where in fact, most are only getting tax preparation.

Steps in Mapping

Step 1 - Create a current tax scenario in the Tax Mapping Software

Step 2 - Let the AI run thousands of route options

Step 3 - Narrow down the route options based on you and your goals

Step 4 - Discuss the costs, actions and ongoing maintenance to set up the right Tax Map

Step 5 - Put the Tax Map Route you chose in action

Step 6 - Set up AI Automation to watch over the route. If you have changes, or the IRS changes then the AI alerts us to consider changing routes.

What do you get with a Tax Map

A personalized map outlining your options to reduce your tax

An assessment of the audit risks for each option

An assessment of the costs to implement any actions if any

An online account with eMoney to track and monitor your progress

Tax Preparation

Collects tax source documents after the tax year has ended.

CPAs and Tax Preparers job is to get the right numbers on the right lines on the tax returns

Any tax advice is done after the tax year has concluded, offering no way to reduce the prior year

Tax Planning

Collects past tax returns as well as entering projected tax numbers for the upcoming year

Using AI to research over 40,000 IRS codes to determine if you are either missing tax reduction strategies or can restructure for future deductions

Monitors revenue, and expenses through the AI to find deductions or changes in the tax code and make immediate deductions

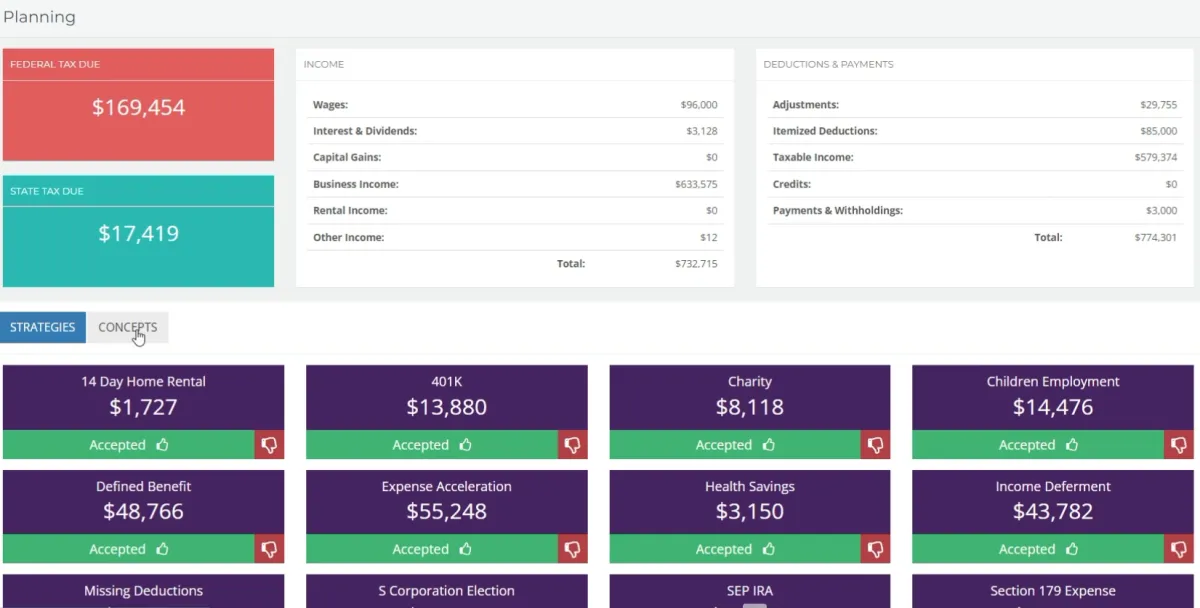

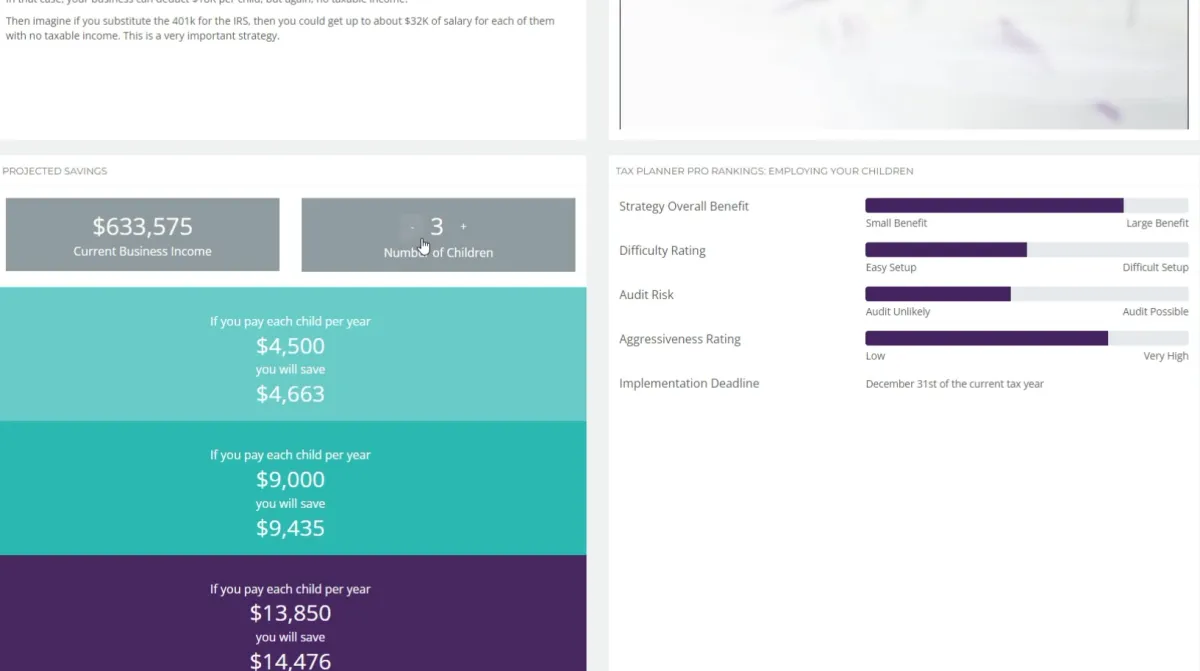

Examples of Tax Mapping AI

Tax Mapping

Step 1 Data Input

It all starts with creating a based line tax projection

We gather the last three (3) years tax returns

We enter the data into our Tax AI Program

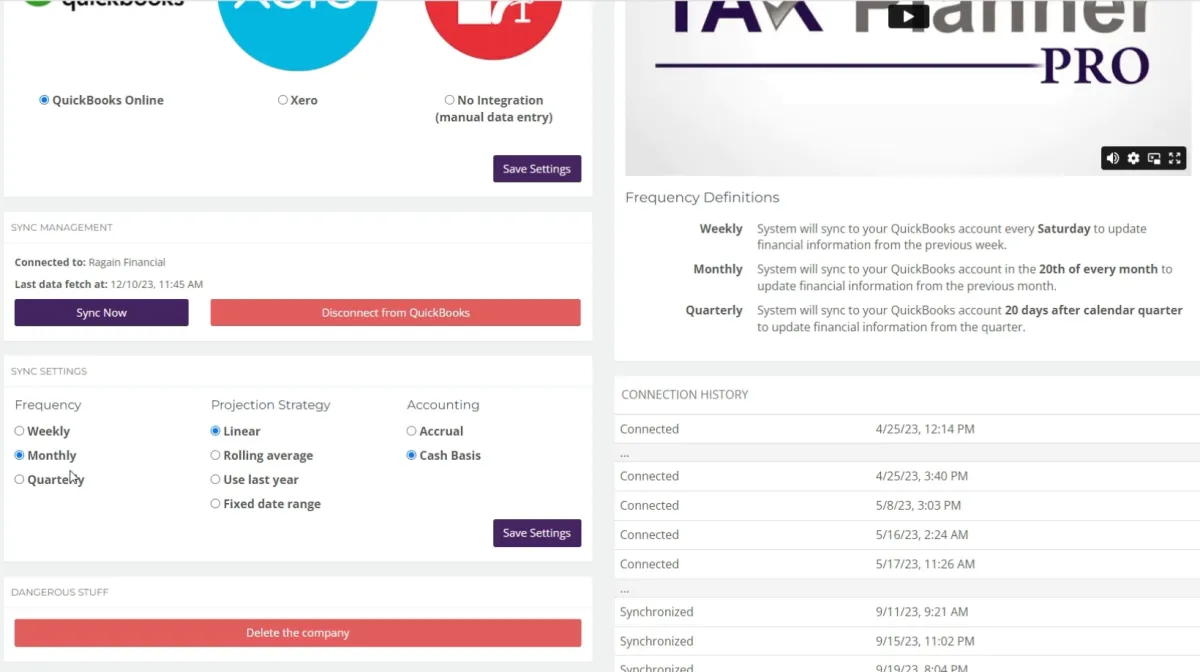

If you have Quickbooks or XERO accounting software we connect to the programs and we download live data including P&L, and Balance Sheets, as well as depreciation schedules.

Tax Mapping

Step 2: Business Information

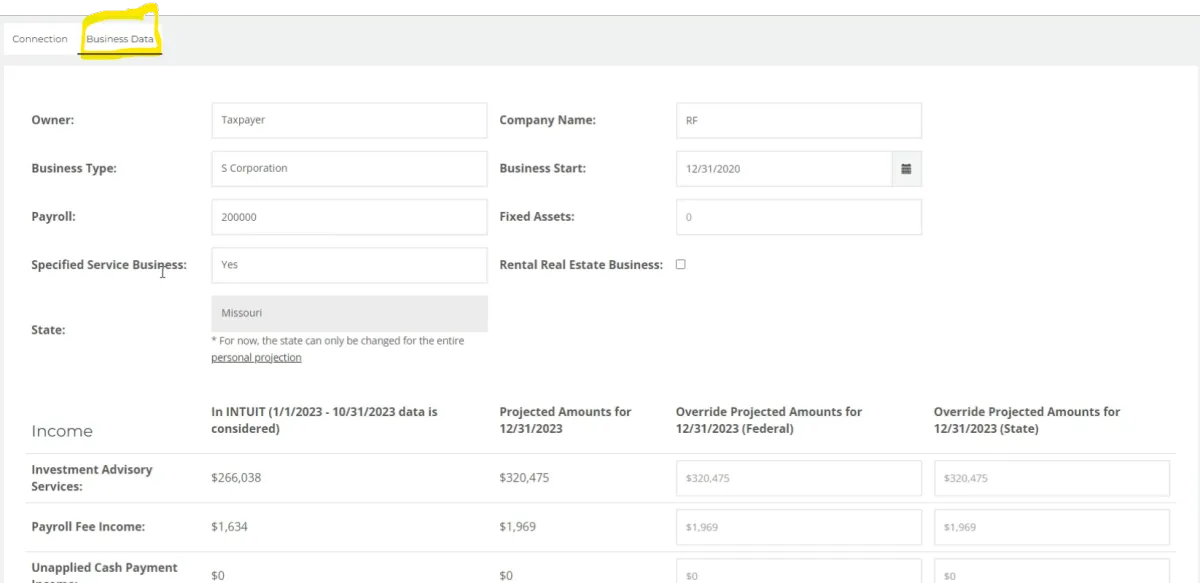

Connecting your accounting software allows quick set up of financials

We set up ownership and tax methods.

**If you don't own an operational business and we are setting up an Asset Protection Plan such as a Family Fortress - we include the various trusts and LLCs in the Tax Plan

Tax Mapping

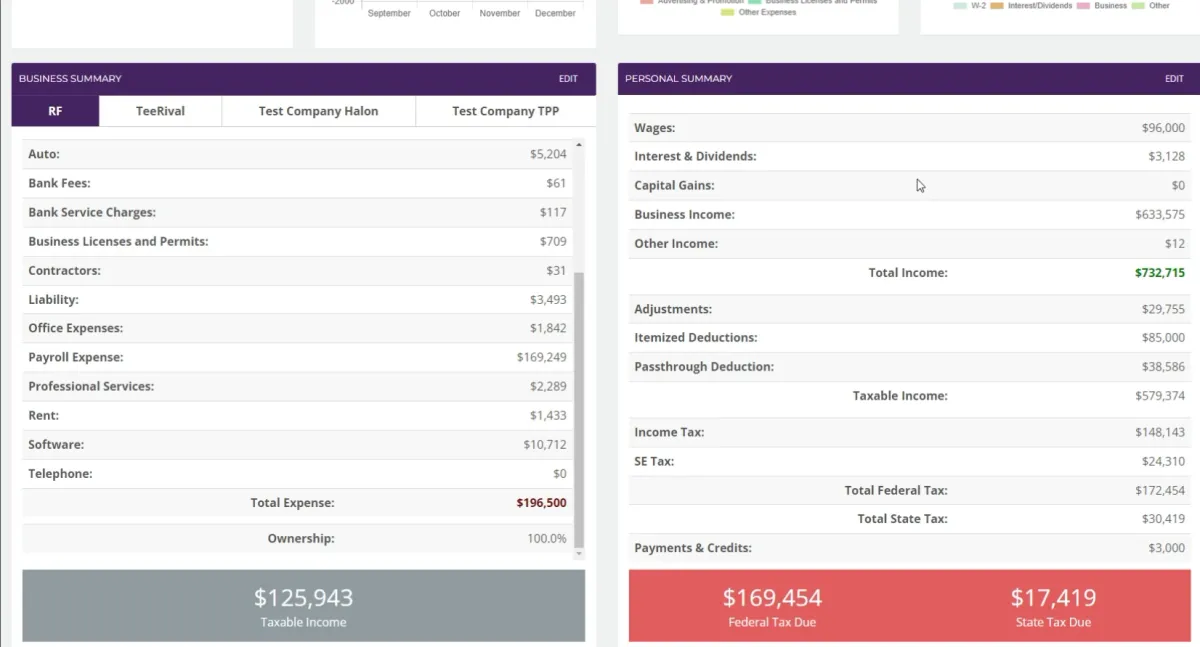

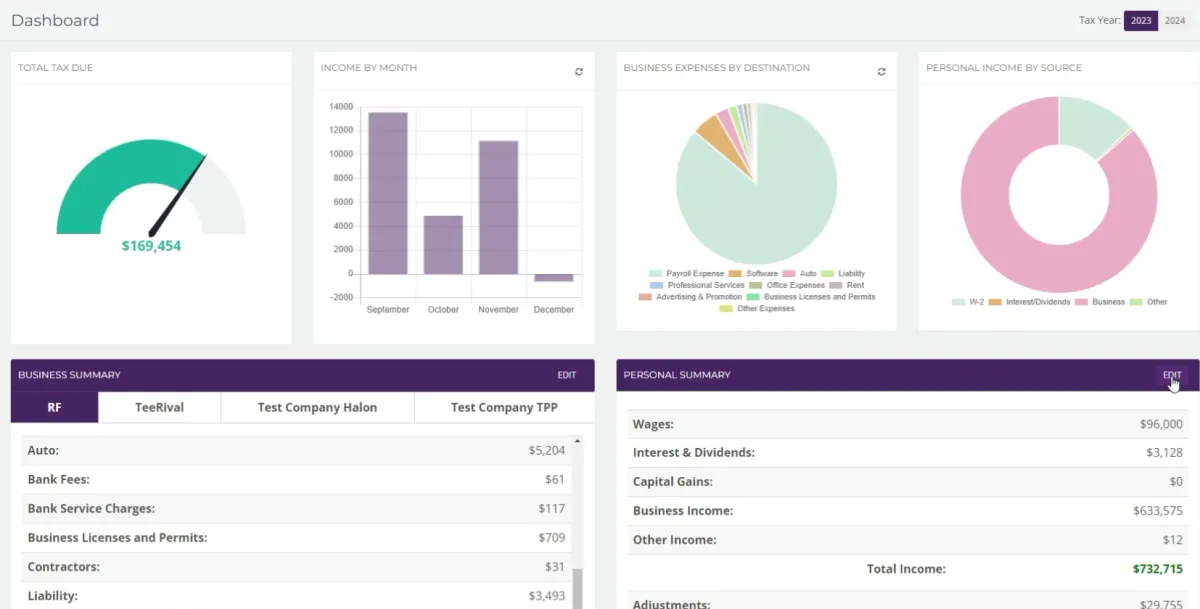

Step 3 Creating Scenarios

Our tax team will create tax scenarios based on your personal situation

as well as your business if you own one.

Tax Mapping

Step 4: Let the AI do the calculations

Based on the data both quantitative and qualitative, we run the AI to develop the options

Tax Mapping

Step 5: Review Options - DOS

We use a method called D.O.S.

Dangers-Opportunities-Strategies

We review each potential option the AI develops to determine

What is the audit risk, and how does much does this strategy save you compared to the risk

We count out certain strategies the AI develops based on our inside expertise on how it might overlap with other areas you are involved with. An example might be that in aggressive real estate acquisition, some banks don't lend to new C Corps or certain types of LLCs.

We narrow down the strategies that we feel comfortable in supporting and defending in case of an audit.

We review your One Map to assure it fits in with both your personal and your business plan if you own a business. (eMoney)

Tax Mapping

Step 6: Review Meeting With You

A review meeting is scheduled for 90 minutes

We review all options and go through DOS with you

We develop an action plan

We assign certain items to us that we can complete

We assign certain items to you that you need to complete

We schedule regular meetings until all action items are completed

Ongoing Steps

We create an automated plan to alert us in the software of any new strategies or ideas that can help you reduce your tax.

One Wealth Map, LLC is a SEC Registered Investment Advisor. For more information on our firm, please visit SEC.GOV for a full Form ADV II and the form CRS. Any discussion, text, video or communication on this site should not be considered a recommendation, projection, or assumption of any returns, risks, or future projections of any type of investment, process or plan. Any recommendation can only be made by one of our licensed advisors after consideration of acceptance as a client. No initial communications, without formal engagement should be considered a recommendation or suggestion. Aspire Tax and Accounting, LLC is a separate, Non-SEC Registered Advisor but is a commonly owned company practicing in tax and business advisory services. . Please visit our privacy policy and terms of service for this website. Please visit our Client Relationship Summary (ADV III) and our Firm Brochure (ADV II) This site is published for residents of the United States only. Investment Advisor Representatives of One Wealth Map, LLC may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Not all of the products and services referenced on this site may be available in every state and through every advisor listed.

Copyright 2025 | All Rights Reserved | One Wealth Map